Traditional banks and financial institutions have long remained the default in the financial market. Still, with users demanding more from their providers on the front of real-time customer support, the ability to track multiple bank accounts, and tools to protect financial health, the sector was long overdue for true innovation.

In response, fintech companies have come up with a new offering – one that checks all the future-readiness boxes – Neobanks.

With its market set to reach US$10.44tn in 2028, neobank business model is the new industry response towards taking some traction away from digital banks.

To help you get started in the domain with a guarantee of success, we will cover multiple facets of neobank app development in this article.

Table of contents

What are the differences between neobanks and digital banks?

While the terms neobanks and digital banks are often used interchangeably, the latter is much wider in scope. The concept of ‘digital banks’ also includes traditional banks which have moved a substantial amount of their services online or banks that have moved online completely.

To help understand the difference better, here’s the neobank vs digital bank view.

- Establishment – Neobanks are the latest additions to the entire banking system, while digital banks can also comprise old banks that have moved their services online, partially or wholly.

- Ownership – Neobanks are often autonomous and unrelated to traditional financial firms. They usually build their financial ecosystem using cutting-edge technology. Digital banks, on the other hand, can be autonomously operating or be part of a bigger traditional bank’s digital branch.

- Services – Neobanks tend to offer a limited range of banking offerings, usually to a set target demographic. This, in turn, lowers the range of banking services.

Digital banks provide a wider number of banking services, like loans, credit cards, investments, etc. - Physical Presence – Neo banks do not come with any physical locations; all of the services are delivered through mobile apps or websites. Physical branches of digital banks usually do exist.

- Technology and User Experience – Both digital and neobanks depend on technology for supplying their offerings, but neobanks are noted for their intuitive and user-friendly interfaces. In the case of digital banks, the experience is based on the institution’s user experience.

- Partnerships – To better their service offerings, neobanks work with third-party companies. They may collaborate with fintech firms to give their users additional services like investment or budgeting tools. Digital banks can also build collaborations but usually create their solutions in-house.

Digital banks usually provide a wide range of financial services comprising of, but not limited to, multiple accounts, loans, mortgages, credit cards, and investment options. The benefits of the neobank app, however, usually lie in the fact that it offers services with low or no fees and provides tools to protect financial health, such as overdraft protection at zero cost.

The different neobank business models

The first big decision that a fintech entrepreneur has to make is in terms of which business model to go for. The option you choose here would have a huge impact on both the acceptance and profitability of the product.

Ecosystem-led

This model works around application programming interface (API) technology, which powers different financial apps to communicate and integrate into the bigger ecosystem. The neo banking app that offers this solution is known for following an ecosystem-led business model.

Interchange-led

The model operates in a way where the neobank app charges a fee every time a transaction happens. Some popular examples of this can be seen in Chime (USA) and Neon (Brazil) apps. Chime get a portion of the Visa fees every time a user does a transaction from Chime Visa.

Credit-led

A popular Brazillian Neobank, Nubank, has applied this model for sustaining profitability and growth. This product operates as a credit card business where it has built its revenue through credit as its base. This business model type earns from transaction fees and makes a profit off of the balances and their interest rates.

Asset-led

The asset-led model, when employed in neobank app development, enables apps to provide saving accounts and deposits to their customers. This helps banks participate in the consumer banking market. A popular example of this is Marcus, by Goldman Sachs of Wall Street. The app focuses on a single set of niche products rather than a diverse range of services to grow and become profitable.

Product Extensions

A well-known example of this popular types of neobanks is Robinhood, which built its product extension some years back, by the name of Robinhood Gold.

The model enables users to get insights into the market that are not otherwise present easily. By offering this solution through a subscription-based model, Robinhood Gold profits from its competitive position in the market.

What are the legal requirements for building a neobank?

Neobanks are not regulated directly, however, the banks they have partnered with to operate in the sector have to adhere to regulatory frameworks and requirements. In this way, the neo banking apps have to meet the regulatory expectations that governments or institutions have from the banks they have partnered with, making them quasi-regulators for the product.

Usually, the fintech app development company you partner with helps with the situation by guiding you through the regulation compliance process.

The must-have neobank app features

Now that we have looked into the basics of neo banking apps, let us get to the technicalities of the neobank app development process – something that would directly impact the speed and quality at which the application is brought to the market.

Real-time transaction handling

The apps come with a feature enabling users to view and manage their transaction history comprising bank statements, card transactions, investment details, and payment details. These comprehensive statements help users get valuable insights into their financial habits and how far they realistically are from their goals.

Budgeting

Several neobank apps now come with the option of in-app budgeting tools that make it easy for users to set their spending objectives, track expenses, and categorize their spending into labels to understand and plan their budgets better. There can also be a feature where the users can get alerts the moment they exceed their planned budget.

Multiple investment options

Neobank apps can take their offerings further by giving users access to multiple investment options such as stocks, cryptocurrencies, bonds, and other instruments. Moreover, the solution should make it easy for the users to keep track of their investment portfolio and modify their investment strategy from within the application.

Cross-border and crypto payments

For a long time, making cross-border payments has been a bank-dependent activity. Neobanks are changing that by making it easy for users to make international payments with the same ease and transparency as that of local payments.

Moreover, the application allows for crypto-related transactions ranging from storing cryptocurrencies to buying and selling them in-app.

Fraud-detection

Every neobank application should be made security-first. But while that is on the backend, on the interface level, there should be a multifactor authentication system, automatic log-out after fixed inactivity time, limitations on number of times users can press back, etc. With a robust backend and security-focused interface, the chance of the app getting hacked gets minimized.

Chatbot support

Having an AI-powered chatbot functionality which can answer users’ queries becomes a necessity when it comes to imparting a feeling of authenticity to the application. One important thing to consider here is that there should always be an option to reel in human advisors when the users make a request.

Multiple payment functionality

Neo banking apps are known for their multiple payment features. The application makes it easy for users to make QR payments or transfers like peer-to-peer, account-to-account, peer-to-account and vice versa, user-to-merchant, etc. by giving users multiple options in selecting the payment methods of their choice, the application makes the entire payment journey easier.

Gamification

Making routine app functions exciting with unique experiences is what a neobank does best. Elements like badges, points, contests, and mascots don’t just improve in-app retention but also investments. An example of this can be seen in Monobank, which gives its users the ability to win mascot-based achievement badges every time they complete a transaction.

e-Wallets

Digital wallets have become a norm in fintech applications and neobanking solutions are no different. They make the entire process of making payments effortless and transparent for the users. For neobanking app owners, it offers the benefit of customer retention and increased app utilization for online transactions.

Cards management

The card management functionality enables account holders to handle their credit and debit cards right from the neobanking application. The users can easily deactivate or activate them, set limits, renew cards, get notifications, etc. saving them the time and effort of switching between applications or making bank visits.

The next question that usually comes after knowing what would go in my neobank app is how much would the neobank app development cost if we add all these key features. Let us look into that.

What would be the cost to develop a neobank app?

Before we dive into giving you the cost range for neobank app development, it is critical to know that it is impossible to give the exact figures until we know the exact requirements. So treat the numbers we are sharing as a rough idea of what the actual estimates could look like.

The cost of developing a neobank app can vary significantly depending on various factors such as features, complexity, development team rates, geographical location, and more. Here’s a breakdown of the costs at different stages of development:

1. Initial Planning and Research Stage

At this stage, you’ll conduct market research, define features, create user personas, and outline the project scope.

Cost Range: $5,000 – $20,000

2. UI/UX Design

Designing the user interface and user experience involves creating wireframes, mockups, and prototypes.

Cost Range: $10,000 – $50,000

3. Development

Backend Development

Development of the server, database, APIs, security protocols, and integrations.

Cost Range: $20,000 – $100,000+

Frontend Development

Implementation of the user interface, navigation, and interaction elements.

Cost Range: $20,000 – $100,000+

Mobile App Development (iOS and Android)

Developing native or hybrid mobile apps for iOS and Android platforms.

Cost Range: $40,000 – $200,000+

4. Testing

Quality assurance and testing to ensure the app functions correctly, is secure and provides a seamless user experience.

Cost Range: $10,000 – $30,000

5. Deployment and Launch

Publishing the app to app stores, setting up servers, and final preparations for the launch.

Cost Range: $5,000 – $20,000

6. Post-Launch Support and Maintenance

Ongoing updates, bug fixes, server maintenance, and customer support.

Cost Range: $10,000 – $50,000+ per year

Overall, the total cost for developing a neobank app can range from $100,000 to $500,000 or more, depending on the complexity and scale of the project. It’s essential to work closely with your finance app development services development team to prioritize features and allocate resources effectively to stay within budget. Additionally, elements like regulatory compliance and security measures may add to the overall cost.

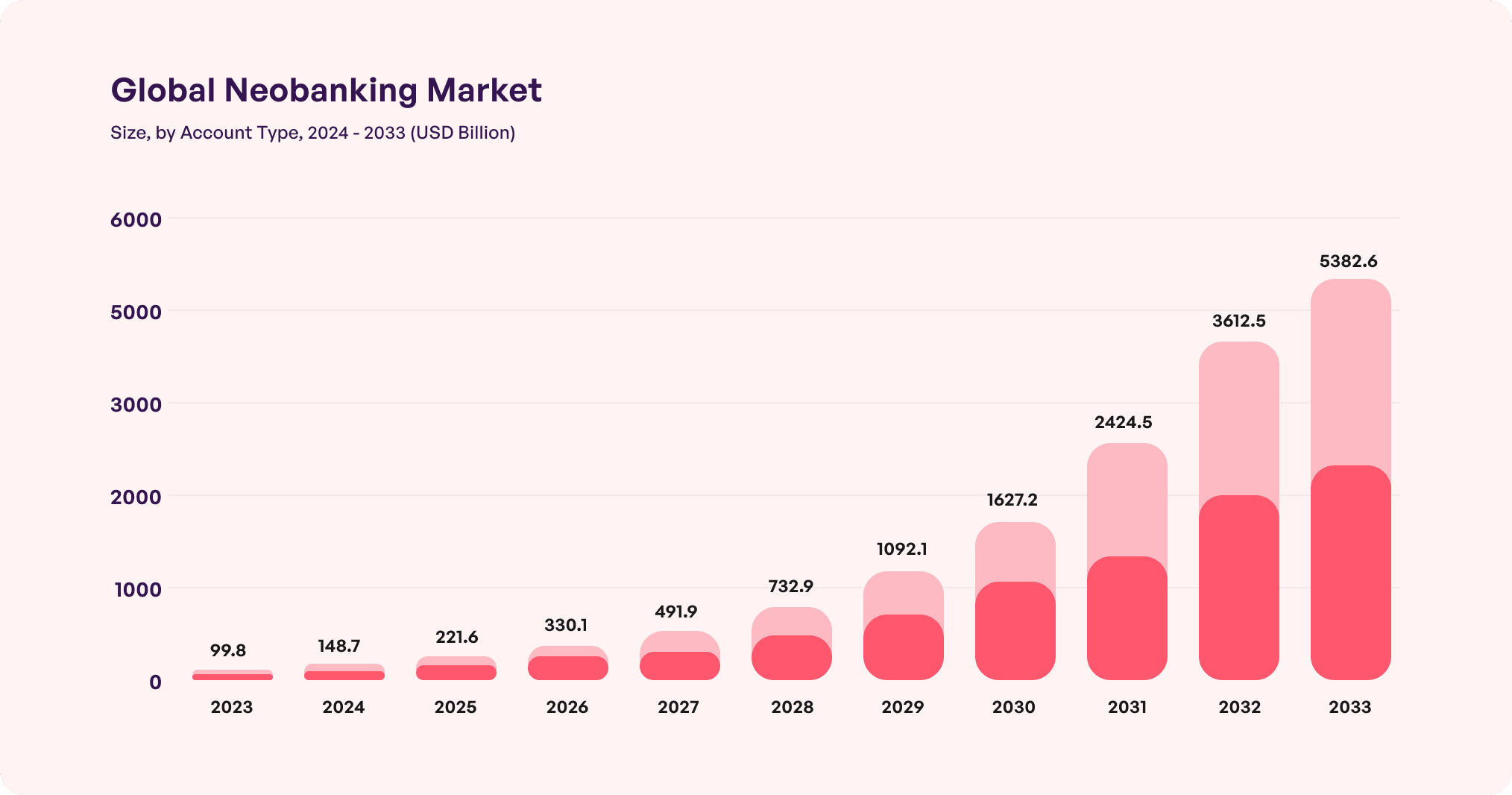

Up until this point, we have looked into multiple facets of neobank app development services with the intent of preparing you for both the business and technical side of the project. But considering the fact that the sector will be worth USD 2775.48 Billion by 2032, it is equally important for entrepreneurs to know how to get a step ahead of the competition.

Let us look into that as we conclude the article.

How to get your neo banking app a competitive edge?

Let’s face it. There was a time when neobanking apps were a hit, every fintech enthusiast wanted to join the revolution. Today, only a few remain at the top position. The reasons?

- Lack of trust from customers

- Banks catching up with their digitalization strategies

- Threat of big tech companies like Apple, Google etc entering the market

There is a way out of this standstill. Niche positioning.

Neobanking apps must apply two methodologies to gain prominence in a competitive market where they are competing with not just other neo banking apps but also banks and tech giants.

- Diversify product range – Almost every top neobanking app offers similar products – credit and debit cards, foreign currency transactions, or short-term lending. There is a massive lack of personalized and flexible products specially in the credit space where there are open opportunities for customization.

- Re-segment customers – Majority of the neobanks work towards retail customers’ share or SMEs because of the high ticket size. This leads to a situation where segments like contractors, independent professionals – doctors, content creators, and the underbanked are not getting covered. Neobanks have a scope of innovation here.

Neobanking apps are undoubtedly a flourishing sector, specially when entered with innovation in mind. We are the digital banking app development company that can help you conceptualize a profitable idea, build a secure, scalable product, and ensure long-term success. Get in touch with our fintech software development team today to kickstart your product.

FAQs

Q. What are the differences between neobanks and digital banking?

A. Neobanks, often referred to as challenger banks, are entirely digital entities that operate without physical branches. They leverage technology to provide streamlined, user-centric banking experiences, often targeting niche markets or specific customer segments. Neobanks typically offer a range of basic banking services, such as savings accounts, checking accounts, and payment solutions, all accessible through mobile apps or web platforms.

On the other hand, digital banking encompasses a broader spectrum, including both traditional banks with digital services and neobanks. Digital banking refers to any banking activity conducted online or through electronic channels, encompassing everything from mobile banking apps provided by traditional banks to fully digital neobanks.

Q. How do neobanks work?

A. Neobanks, revolutionize the banking experience by operating exclusively online, devoid of physical branches. Through user-friendly mobile apps and web platforms, they offer a seamless banking experience, allowing customers to open accounts, manage finances, and conduct transactions with ease. By streamlining operations and leveraging technology, neobanks minimize costs and pass on the benefits to customers through competitive fees and higher interest rates.

The apps may collaborate with third-party fintech firms to broaden their service offerings while ensuring compliance with banking regulations and safeguarding customer data.

Q. What are the key features of neobanks?

A. The feature list of neobanks can expand as far as your imagination goes. However, here are the ones that can be commonly found across the most used applications.

- Real-time transaction handling

- Budgeting

- Multiple investment options

- Cross-border and crypto payments

- Fraud-detection

- Chatbot support

- Multiple payment functionality

- Gamification

- e-Wallets

- Cards management

Q. What are some popular neobanks in the US?

A. At the time of writing this article, here are the top neobanking apps in the USA – Chime, Current, SoFi, Revolut, and Acorns.