Have you ever wondered what compliance in the fintech landscape could be? It is like riding a roller coaster while you juggle flaming torches. From one perspective, it may be thrilling, yet it is truly frightening if you are not prepared. Therefore, businesses should look into how to balance the rapid expansion of technology with financial reporting standards such as US GAAP and rigid regulations such as anti-money laundering (AML) laws and data privacy like GDPR. Nevertheless, the speed of technological advancements often leaves regulators lagging behind, which forms a gray area where fintech firms should be very careful.

Or else, one wrong move and they may be in a situation where their reputation will be at stake, or even worse they will have to pay penalties which will be a serious obstacle for their digital transformation initiative. Hence, being compliant and innovative would be the only way to get the job done. To clarify, let us first understand the fintech compliance challenges, and what are the efficient solutions to them that can help manage them in an informed way without hiccups. Read on.

Table of contents

Brief overview of the compliance challenges of fintech firms

Fintech firms, especially the small ones, typically face compliance challenges due to limited resources and external technological disruptions. Plus, the cost of implementing compliance technologies like blockchain, AI, and ML can be difficult for them to bear. However, this should not suppress the criticality of abiding by standard guidelines.

A PwC survey of business and risk leaders reports that 40% of them have improved their organization’s risk approaches with strong compliance to regulatory standards while this number jumps to 81% for top performing companies.

Businesses could end up relying on more manual processes leading to human error. Further, non-compliance risks, including hefty fines, reputational damage, and legal issues leading to strained competitiveness make it essential for small financial firms to ensure regulatory obligations.

Key compliance laws and acts for fintech firms

Fintech companies work within a regulated atmosphere which necessitates compliance with a plethora of laws and regulations that are both legal and ethical.

- Bank Secrecy Act (BSA): Financial institutions and fintech companies are required to assist the government in the detection and prevention of financial crimes through reporting and recordkeeping.

- Know Your Customer (KYC): The directive is given to fintech firms to confirm the identity of their clients so that the risks of illegal activities would be minimized.

- Anti-Money Laundering Laws (AML) Regulations: Enforces the measures that mitigate the money laundering activities and also include customer verification and transaction monitoring to prevent, detect, and report money laundering activities.

- Gramm-Leach-Bliley Act (GLBA): Regulation – Focuses on the collection and safeguarding of the consumers’ personal financial data and also, it is compulsory for the financial institutions to provide privacy notices to the customers for transparency.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: These are the wide-ranging financial regulations including consumer protection measures and the creation of the Consumer Financial Protection Bureau (CFPB).

- Payment Card Industry Data Security Standard (PCI DSS): Regulation – Security standards for organizations like credit unions or banks have been set to ensure secured and trusted transactions.

- General Data Protection Regulations (GDPR): This regulation is related to companies having business in the EU and is focused on data protection and privacy matters.

- Consumer Financial Protection Act: Introduces a structure for guaranteeing the protection of consumers in the financial system and accordingly a fair treatment, non-biasness, and transparency are demanded.

- Securities Exchange Act of 1934: Governs the operation of capacity on securities trading allowing the regulators to compel transactions adhering with the trader’s reporting and disclosure obligations.

- Electronic Fund Transfer Act (EFTA): Concerns digital money transfers and defines the duties, rights, and responsibilities of the parties engaged in such transactions

What is the role of the above compliances in finance?

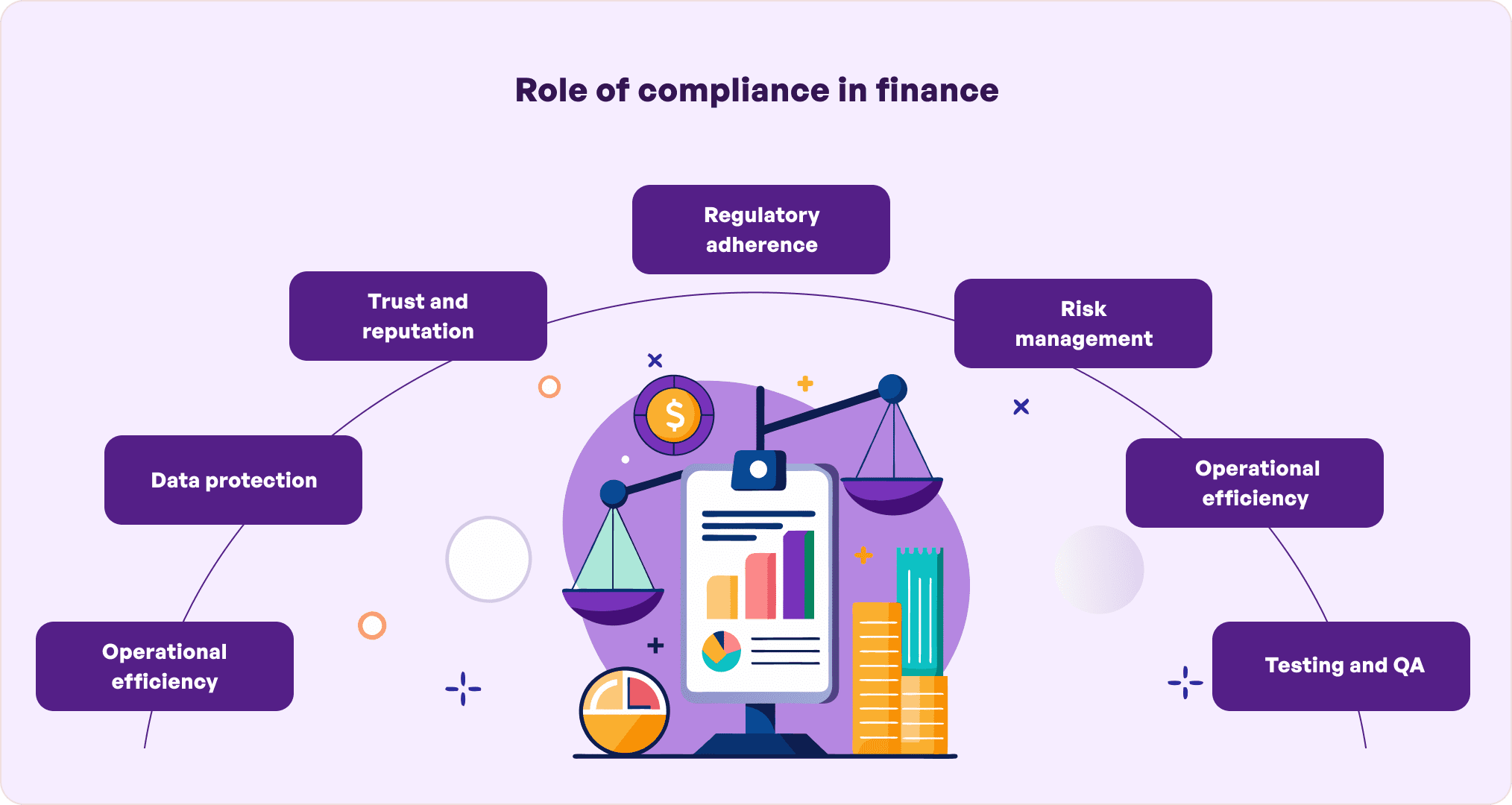

Finance compliance denotes that the companies are provided legal and regulatory standards which in turn helps to reduce risks such as data breaches. Thus, it animates honesty, safeguards the interests of the customers, and ensures the financial institutions’ reputation and stability. There are compliance’s detailed functions in finance given below:

Regulatory adherence

The fintech regulatory compliance provides that financial institutions follow the latest laws, rules, and guidelines of regulatory bodies such as CFPB. Task-oriented compliance teams track regulation changes, understand why they matter for the company, and teach the staff how to create the necessary policies and standards. Compliance is also the regular training sessions and audits so that employees get the full regulations and follow them for their organizations and customers.

Trust and reputation

The adherence to compliance rules creates a safe environment and is therefore credited with trust and loyalty to the organization thus ensuring strong reputation by minimizing fintech cybersecurity challenges involved in the fintech. By complying with these regulatory requirements, organizations also demonstrate their commitment to highly ethical practices and transparency, which are the main factors that reassure clients, investors, and regulators. A compliance system that is managed well guarantees that the company acts according to the law which, in turn, minimizes the chances of scandals, fraud, or legal penalties that could otherwise damage its public image.

Risk management

Regulatory compliance in finance plays a crucial role in risk management by establishing frameworks that help institutions identify, assess, and mitigate potential risks. By adhering to regulatory requirements such as AML laws and data protection regulations, compliance ensures that firms have robust cybersecurity services in place to prevent and detect fraud, threats, and similar crimes. Regular audits and reporting further reduce the chance of legal infractions, fines, or operational disruptions.

Financial stability

By enforcing regulations that govern financial institutions, compliance helps prevent activities such as fraud and excessive risk-taking, which can lead to economic instability. A robust compliance framework fosters transparency and accountability, encouraging trust among investors, consumers, and regulators alike. This trust is essential for maintaining investor confidence and encouraging capital flow in the markets. In short, a commitment to compliance contributes to a stable and resilient financial environment.

Data protection

Compliance ensures that financial institutions stick to stringent data privacy laws such as GDPR and CCPA. It mandates the implementation of policies and technologies to safeguard customer information which is necessary as a part of data privacy and cybersecurity in fintech startups. This includes encryption, secure storage, and controlled access. Ultimately, by enforcing rules on how data is collected, processed, and shared, compliance minimizes the risk of data breaches and unauthorized access.

Operational efficiency

By implementing clear compliance frameworks and policies, organizations can create standardized procedures that reduce confusion and enhance workflow. This ensures that employees understand their responsibilities and follow regulations, resulting in fewer errors and delays. Additionally, compliance initiatives often involve the integration of technology solutions such as automated reporting and monitoring tools which can significantly reduce manual tasks and free up time for strategic activities.

To ensure all of this, consider partnering with a trusted fintech software development company like Simublade. Our experts have a proven track record of building products that are compliant to government and industry-driven regulations like GDPR, AML, ePrivacy, FinCEN, PA-DSS, and PCI-DSS. The best part is that the cost still remains affordable, that is, between $45K and $80K. On-time and in-budget delivery further makes the entire process quite seamless for fintech institutes.

What are the fintech compliance issues ?

Here are the fintech compliance challenges faced by all firms:

- Rapidly evolving regulations: Keeping up with constantly changing laws and regulations at local, national, and international levels.

- Limited resources: Smaller teams and budgets make it difficult to hire dedicated compliance staff or invest in compliance technologies.

- Complexity of compliance requirements: Navigating the intricate landscape of regulations, including AML, KYC (Know Your Customer), and data privacy regulations for fintech.

- Data security and privacy: Ensuring compliance with stringent data protection regulations while managing large volumes of sensitive customer information.

- Integration of technology: Implementing and maintaining compliance technology solutions that effectively monitor and report compliance issues.

- Cross-border operations: Managing different regulatory needs when operating in multiple locations via cross-border payment apps can complicate compliance efforts.

- Cultural and organizational challenges: Building a compliance-oriented culture within a fast-paced, innovative environment that prioritizes agility and growth.

- Reputational risk: The potential damage to reputation from compliance failures or breaches which can affect customer trust and business viability.

- Lack of established precedents: Operating in a relatively new industry with limited historical data for regulatory guidance leading to uncertainty in compliance practices.

- Balancing innovation and compliance: Striking the right balance between driving innovation and adhering to regulatory standards can be challenging.

What are the impacts of non-compliance in fintech firms?

Non-compliance can have severe and far-reaching consequences significantly impacting their operations, reputation, and financial stability. Regulatory fines and penalties can be hefty, often crippling for smaller firms, and can lead to substantial legal costs associated with defending against compliance violations. For instance, a survey of 200 professionals found that the organizations of 86% had paid more than $50,000 in compliance fines in 2023 and 37% paid more than $500,000, a top concern in 2024 and beyond.

Apart from such monetary repercussions, compliance risk challenges in financial services include damaged firm reputation, eroding customer trust and confidence, which are crucial in the competitive fintech landscape. This loss of credibility may result in decreased customer retention and acquisition, ultimately affecting revenue streams.

Further, regulatory scrutiny can increase causing more frequent audits and monitoring, which can disrupt operations and divert resources from innovation and growth. In severe cases, persistent non-compliance can lead to the revocation of licenses or operational shutdowns, posing existential threats to the firm. So, maintaining robust compliance frameworks is essential for fintech firms to avoid these detrimental impacts and ensure long-term success.

Now, let us look at the best practices of financial compliance.

How to ensure compliance in fintechs?

Regular training on policies and procedures along with clear communication foster a compliance-oriented culture in fintech firms which is crucial to maintain adherence to evolving laws and standards. Below are a few things to follow to avoid compliance challenges in fintech firms:

Compliant fintech software

Fintechs, especially startups and small firms, must consider a financial compliance solutions software to :

- streamline their compliance to complex regulations

- reduce the risk of non-compliance

- enhance operational efficiency.

They help automates processes such as transaction monitoring, customer due diligence, and reporting, significantly decreasing the chances of human error. Well-compliant banking apps and platforms, like the ones built by Simublade, also provide real-time insights allowing firms to quickly identify and address potential issues.

Moreover, as requirements evolve, a regulatory compliance solution for fintech firms can be updated to reflect the latest standards helping fintechs stay agile and responsive in a dynamic landscape. Ultimately, investing in such software safeguards against legal penalties and builds trust with customers and stakeholders thus fostering long-term business success.

Leveraging technology for compliance

Fintech firms should leverage advanced technologies like AI, ML, cloud, blockchain, data analysis, and predictive analytics to tackle compliance challenges effectively. Implementing data analytics and machine learning can especially enhance risk assessment and fraud detection capabilities.

Automated systems can streamline processes like customer due diligence and transaction monitoring, reducing the burden on staff while improving accuracy. Additionally, using cloud-based solutions can facilitate secure data storage and sharing, ensuring compliance with data protection regulations.

Understanding regulatory requirements

One of the first steps in addressing regulatory compliance in fintech firms is to thoroughly understand the regulatory landscape. This involves staying updated on laws and regulations that impact the industry, including anti-money laundering (AML), data protection, and consumer protection laws like GLBA.

Fintech firms should also invest in regular training sessions for employees to ensure everyone is aware of compliance requirements and understands their responsibilities. Establishing a dedicated compliance team or hiring developers who are compliance experts can also provide the necessary expertise to navigate complex regulations effectively.

Implementing compliance framework

Developing a comprehensive compliance framework is essential for fintech firms to create a structured approach to meet regulatory demands. This framework should include clear policies and procedures for compliance, risk management, and internal controls. Regular reviews and updates to these policies will help ensure they remain relevant and effective as regulations evolve, something that can be assured by utilizing technology such as compliance software solutions for small firms can streamline processes, automate monitoring, and facilitate reporting, thereby enhancing the efficiency of compliance efforts.

Regular audits

Conducting regular audits and assessments of best compliance practices for financial compliance is essential for identifying gaps and areas for improvement. An audit checklist must include technology infrastructure, internal control management, and data security. These evaluations can then help fintech firms stay proactive in addressing potential compliance risks before they escalate. Moreover, engaging external auditors or compliance specialists can provide an objective perspective and valuable insights into enhancing compliance programs.

Conclusion

Fintech firms face significant compliance challenges that can impede their growth and sustainability in a competitive landscape. The complexity of regulatory requirements, limited resources, and the rapid pace of technological change can create a daunting environment for compliance management.

However, working with professionals will help with financial compliance solutions like establishing robust compliance frameworks, leveraging technology, and fostering a culture of compliance so firms can effectively navigate the regulatory landscape. Investing in custom compliance software development from a top fintech application development company and conducting regular audits can further streamline processes and mitigate risks.

FAQs

Q. What are some cost-effective solutions for improving compliance in small financial firms?

Ans. Utilizing cloud-based compliance software, automating reporting processes, providing employee training, and leveraging open-source tools for risk management and monitoring are a few cost-effective financial compliance solutions.

Q. How can fintech startups manage data privacy and security compliance?

Ans. Data privacy regulations for fintech can be managed by implementing robust data protection policies, conducting regular security audits, utilizing encryption technologies, and ensuring adherence to relevant regulations such as GDPR and CCPA.

Q. Why is AML and KYC compliance critical for fintech startups?

Ans. AML and KYC compliance is critical for fintech startups to prevent financial crimes, protect against fraud, and build trust with customers and regulators thereby ensuring long-term sustainability and legal adherence.

Q. How can fintech startups manage the cost of compliance?

Ans. Fintech startups can manage the cost of compliance by adopting scalable compliance software solutions, automating routine compliance tasks, leveraging cloud-based services to reduce infrastructure costs, conducting regular training sessions to empower employees, and prioritizing risk-based compliance approaches.

Q. What are the risks of non-compliance for fintech startups?

Ans. The risks of non-compliance for fintech startups include hefty fines, legal penalties, reputational damage, loss of customer trust, and potential operational shutdowns, which can severely hinder growth and sustainability.