Businesses and investors who observe and analyze world economies are worried about gradually entering an era of de-globalization. The term means reducing external dependencies and focusing on local business solutions with inward-looking strategies while shrinking world interconnectivity in terms of trade.

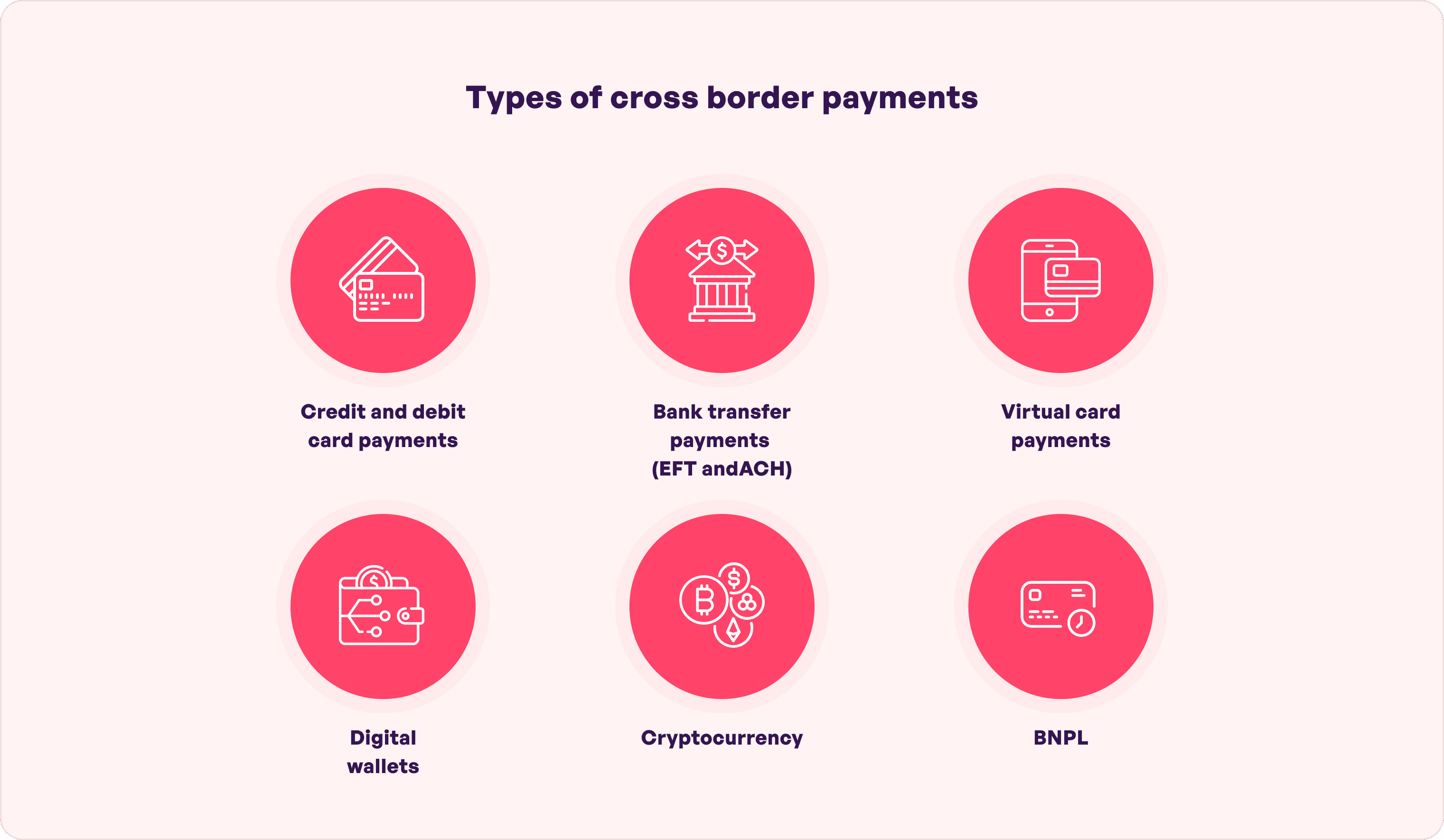

However, the good news is that there are no significant signs of this phenomenon in global trade data yet. This is clearly established by the rise of cross-border payment solutions like credit and debit card payments, BNPL, cryptocurrencies, global ACH payments, digital currencies, and digital wallets. It is an indicator of steady and continued flow of goods and services, technologies, and information – now and in the near future.

Here’s more proof. International transfers are predicted to increase by 5% per year till 2027 which is due to the previously ‘unbanked population’ who now have access to financial tools. So, you can rest assured that the market situation is ripe enough for the launch and success of cross border payment apps. But, how to get started?

A shortcut would be to collaborate with a visionary and trusted fintech app development company like Simublade that offer services in the USA and UAE. Our payment app developers build financial platforms with next-gen technologies that are breach-proof, ensuring secure and seamless international money-transfer across iOS, Android, and web platforms.

But before that, we recommend reading this article which will help get started with an overview of the development process and answers all relevant questions.

Table of contents

The core benefits of using cross border payments

There are plenty of benefits that come along when businesses start accepting cross border payments and explore new markets. Here’s a glimpse:

- Convenience: Lets customers choose their convenient payment method which aids in satisfaction and encourages repeat purchase.

- Easy transfer: Helps businesses save on foreign exchange fees and currency exchange rates that are associated with foreign trades.

- Competitive edge: Integrating a cross border payment system means ensuring a strategic position in the market which keeps your business in the forefront of your customers’ minds.

- Growth opportunities: Helps small and medium-sized enterprises tap into lucrative growth opportunities and drive revenue. This is especially true if they are able to partner with international fintech companies and banks for efficient transactions.

- Better reach: Allows diversification of the customer base across several countries. Businesses also get exposure to partners, investors, and suppliers in multiple locations across the globe.

Apps like PayPal, Venmo, and Google Pay are already offering these exciting benefits. So, consider careful planning and attention to detail which will help in the success of the cross border payment platform and contribute in building a future-ready brand for you.

Common challenges of cross border payment

Despite countless benefits like business flexibility, customer loyalty, and an entry into new markets, cross border payments do have their share of challenges. These include:

- operational complexity in payment processing

- legal roadblocks

- data privacy and protection

- compliance pitfalls

- operational malfunctions

- fraud and security compromise

- fees and exchange rate management

However, partnering with trusted developers with refined skills and hands-on experience in cross border payment applications can help mitigate these issues without delaying project timeline or compromising the quality of the end result. Enterprises and startups can also depend on tech experts, like the ones at Simublade, who can analyze payment histories and analytical statistics to implement cybersecurity hacks as a part of their maintenance process, to spot and stop phishing and malicious activities. This helps businesses to grow without reputational and financial losses.

5 key features of a cross border payment app

Cross-border payment is a strong economic force and can be utilized via apps that are typically a single platform with domestic and foreign currencies and money transfer facilities operating in a transparent setting. Below are the top features you must know before building a cross border payment app to foster profits and popularity.

1. Mass payment processing

Consider creating a global cross border payment gateway that dedicatedly supports mass payment. This means it should be able to accommodate countless types of cross border payment transfers as per unique methods like bank transfers or electronic fund transfers without a glitch. Intelligent routing and cascading must be available as well. Intelligent routing means automatically selecting a bank for transaction while cascading means handling and processing payment declines. With these, businesses can smoothly achieve the following :

- pay employees and vendors outside of the national border

- consider remittances, investments, and partnerships.

- collaborate with businesses and clients overseas

- receive payments from non-domestic customers via your cross border payment platform

- facilitate smart checkout in terms of currencies and local language

Further, consider generative AI integration since this technology can enhance efficiency and security by sophisticating fraud detection to boost consumer trust. Further, customer experience can be heavily personalized by suggesting recommendations based on individual spending habits.

2. Wide currency choice

You must establish offshore wire networks during the payment app development that support friction-free transactions in multiple currencies. This simplifies conversions for customers which is a fantastic way to attract and retain them. However, remember to check regulatory requirements (discussed in the next point) of different payment processes and do set limits on money flow as per network availability and location. Further, use hedging tools to protect against exchange rate fluctuations to prevent unexpected losses and gains that hinder business funds.

3. Regulatory compliance

A complex landscape of rules and regulations dominate the global payment industry and businesses must be in compliance with local payment systems, laws and frameworks, and transaction fees to avoid legal repercussions. Here’s a list of the key regulatory tools for better understanding and implementation:

- North America – Electronic Funds Transfer Act (EFTA) and Payment Card Industry Data Security Standard (PCI DSS)

- Latin America – Brazil’s Payment System’s Act and Mexico’s AML Law.

- Europe – General Data Protection Regulation (GDPR) and Payment Services Directive 2 (PSD2).

- Asian countries: Payment and Settlement Systems Act applicable to countries like India and China.

Other compliance applications include FinCEN, ePrivacy, PA-DSS, AML, and FINTRAC. At Simublade, when we build a Fintech app, we bring regulations-approved finance app development services on the table since we have successfully unblocked the particulars of a compliant application.

4. Robust refund policy

Develop a payment processor which is able to support refunds in the original mode of transaction in line with the FOREX policies and exchange rates. Next, make sure a strict authorization protocol is in place to ensure authenticity. Lastly, monitoring the refund strategies is highly necessary to ensure better services.

Not implementing this cross border payment app feature accurately could lead to customers receiving incorrect amounts which has a profound impact on customer attitude and brand loyalty.

5. Powerful security measures

Businesses must ensure proactive cybersecurity steps during cross border payment app development including two factor authentication, multi-factor authentication, encryption, fraud detection measures, and advanced protocols like Transport Layer Security (TLS) and Secure Socket Layer (SSL). Enhanced payment security can eliminate the risks of fraudster attacks, account takeovers, hacking and abusing data, and malicious activities. Further, the role of AI in data privacy cannot be overlooked which further strengthens your application.

5 Things to consider when building a cross-border payment app

It is true that the benefits of using cross border payments are many. To maximize their potential and avoid risks, below are a few things to consider before building an app.

1. Developers’ team

Outsourcing app development process to expert developers with prowess in building fintech apps is a cost-effective and risk-free approach. The end result is a responsive, compliant, and insightful cross-border payment app. These benefits make it a good idea to look for an app development company that has a strong portfolio of delivering high-quality work at reasonable prices without compromising on the app design and functions.

2. Localization

An app with local language integrations along with UI UX designs matching the regional culture and preferences is important. Further, keeping local buying patterns and attitudes in mind are also necessary to attract customers and cater to their needs accordingly. Lastly, ensure seamless integrations with local traditional banks, financial institutions like fintechs, and payment networks for impeccable processing.

3. Security concerns

An online business is typically up against several frauds and risks. Here’s proof: The 2024 AFP Payments Fraud and Survey Reports had documented 80% of companies fell prey to payment fraud attacks in 2023 which is a 15% rise from the previous year. So, it is necessary to partner with payment app developers who are able to implement cybersecurity measures and build you a software that is secure and compliant with data protection laws.

4. Tech stack

Top notch fintech app development companies like Simublade use the most advanced technologies to ensure the cross border payment app is fast, secure, and reliable. The stack will include AI, blockchain,and IoT along with following government and sector-driven regulations to build a customer-friendly app with flawless functionalities. It is a good idea to understand what goes inside your app to stay abreast of updates and releases.

5. Transparency

Not maintaining transparency about transaction fees and exchange rates can be quite costly for your business. So, make sure your customers and stakeholders are up to date with these aspects along with a clear idea of terms and conditions of the receipts and records of their cross-border payments with your business.

Now, having explored the basic considerations in detail, let us now look at the cross border payment app development process.

A step by step guide for cross-border payment app development

A well-built cross border payment application means integrating payment capabilities that ensure easy money transfer without security gaps. Here’s how it is done:

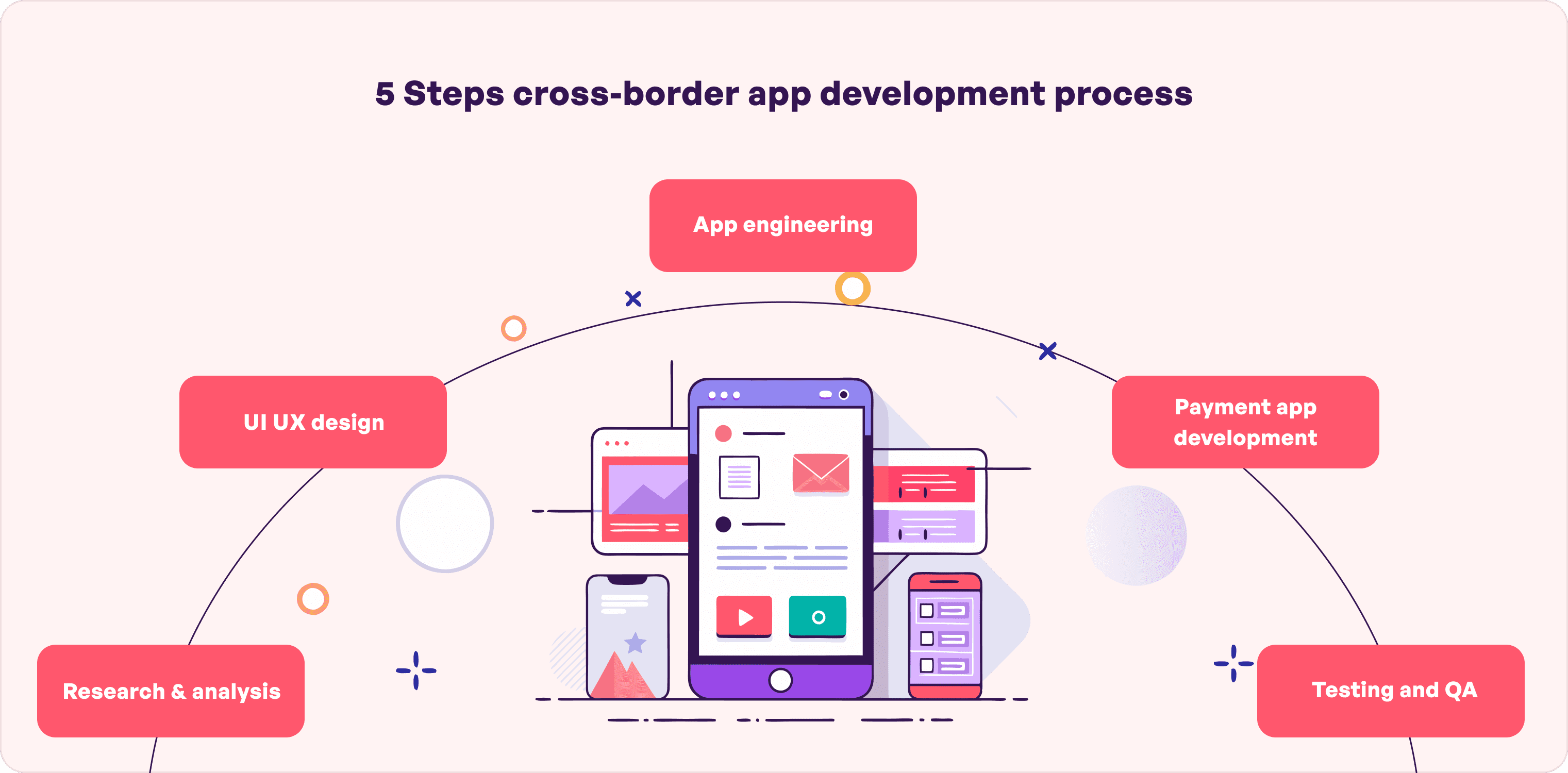

Step 1: Research & analysis

This is when payment app developers conduct market research, prioritize features, and define the target audience for you. Businesses can get structural clarity, visualize their ideas, discuss success metrics, receive guidance on software and technology integrations, identify risks and solutions, and know the expense estimations in a discovery workshop session.

Step 2: UI UX design

UI UX design capabilities are merged to technical prowess with mind mapping to ensure smooth navigation, multi-platform experience, and seamless customer onboarding. These are done by factoring in information architecture and design consultation process to make sure the business and the designer team are on the same page.

Step 3: App engineering

A design sprint session is held where stakeholders are allowed to share their ideas, questions, and confusions openly while the developers share user persona and app journey and request for concept validation with a product roadmap. Next, clickable high-fidelity prototypes and MVP development are successfully done for end-user validation and market acceptance. In the end, you can get an insight-filled report for your reference.

Step 4: Payment app development

This is the most crucial step of cross border payment app development since a robust tech stack integration, implementing cybersecurity measures, API streamlining, testing, and refinement are performed by highly experienced developers. At Simublade, our experts also embed blockchain,IoT, geolocation, and AI technologies to promote financial awareness and establish secure money transfers across borders.

Step 5: Testing and QA

The team will ensure the app meets the highest standards of quality, security, and functionality through multiple rounds of testing. This typically falls under the quality assurance stage including unit, performance, automation, usability, and system testing to ensure there are no gaps or loopholes in the cross border payment solution.

After this, the application is successfully launched followed by maintenance support to keep it updated with the latest trends and security features. An acceptance test is also performed so your app remains right on the top.

What is the cost of building a cross border payment app?

Cross border payment app development cost is somewhere between $100,000 and $500,000. It will depend on selected features, tech additions, design system, and team size and location. Businesses can hire developers starting at $25 per hour at Simublade which helps reduce the overall development expenses.

Top cross border payment solutions trends

Cross border payment has bright and innovative trends with immense potential to revolutionize the finance market. This must be factored in when businesses consider setting up a payment application. Read on to get an idea.

Growth across categories

The cross-border payment gateway has rapidly become popular among categories like B2B, C2B, B2C, and C2C. The B2B cross-border payment market is especially estimated to increase by 43% with the rise of B2B e-commerce transactions. Altogether, cross-border payments are all set to be a critical component of the globalized economy.

Blockchain integration

Modern cross-border payment platforms can be integrated with blockchain which makes it faster than traditional online methods. For instance, half of the payments can reach the destination bank within 5 minutes. In fact, cross-border payments is considered to be one of the most prominent use cases of blockchain.

Real-time pay processing

This is an emerging trend with high-value cross-border transactions to ensure complete transparency in the process. The process included instant settlement of payments after they were initiated and several countries around the world are already reaping the benefits. This includes lower costs, speed, and efficiency.

How to get a competitive edge with cross border payment?

Getting an edge over competitors is of utmost importance for better sales and margin along with acquiring and retaining more customers. Start by researching the untapped market segment consisting of potential buyers across different locations and demographics. Such markets typically are low in competition, have unmet needs, and are brimming with exponential growth and innovation potential. Further, look for non-traditional or emerging customer sectors as well who can be early adopters of your offerings.

Now, get an idea of their purchasing power and market size and accordingly be ready to add new features, modify product prices, and change the way you brand and market your business. Knowing that penetrating an untapped market could be risky but this leap is worth it with the backing of a robust cross platform payment app.

The future of cross border payment

The global cross border payment market size is estimated to reach $356.5 trillion by 2032 growing at 7.3% CAGR from 2022. One of the top drivers of this growth is the popularity and global expansion of e-commerce platforms which is rapidly increasing the demands for reliable cross border payment solutions.

Further, there is a strong expectation of technological advancements in this overseas payment market with the integrations of blockchain, IoT, AI, ML, and Central Bank Digital Currencies (CBDCs). This will power innovation, security and convenience and thus bring a revolution in the developing economies.

FAQs

Q. How can security be ensured in cross-border payment apps?

Ans. The best fintech app development company offers two factor authentication, multi-factor authentication, fraud detection measures, encryption, and advanced protocols like Transport Layer Security (TLS) and Secure Socket Layer (SSL) in the cross border payment apps.

Q. How long does it take to develop a cross-border payment app?

Ans. Building a cross border payment app can take several weeks to months depending on the app complexity.

Q. How to integrate currency conversion in payment apps?

Ans. The best way to get this done is with the help of a payment app developer who can integrate an all-in-one converter solution in the payment application.

Q. What are the key features of a cross-border payment app?

Ans. The key cross border payment app features are payment gateway, refund option, robust security, currency choice, cascading, and intelligent routing.

Q. How much does it cost to develop a cross-border payment app?

Ans. Cross border payment app development cost is between $100,000 and $500,000.

Q. Can cross-border payment apps be integrated with existing financial systems?

Ans. Yes, specialized payment app developers at Simublade can make this possible.