There is a general belief among fintech entrepreneurs that because the sector deals with money – something people work with in every phase of their day and life – it is recession-proof and investor-friendly.

Being constantly on top of market movements, we know that data does not back this notion. If anything, fintech investors have become overly conscious over time because of the emergence of a myriad number of projects with poor business models and severe operational inefficiencies.

To find a space in investors’ portfolios, fintech businesses will not have to think of a blue ocean strategy – either solve a problem that no one else is or change the approach to solving an existing problem revolutionarily. Moreover, they will need to keep a lookout on the macro events at play, for example, US elections where it can be perceived that if Trump comes into the picture again there’ll be fewer regulations in cryptocurrencies in the USA, otherwise, crypto projects will face many complex regulations and laws. This is only one example of many geopolitical events entrepreneurs must prepare for.

Assuming you are in the market with an immense interest in the fintech space and an end goal of getting funded, it is critical that in addition to understanding the micro and macro players, you have a high-level idea of what it is that investors are looking for from fintech subsectors.

While it is almost impossible to be certain about which sub-domains would get you investment in fintech, since it ultimately boils down to innovation and business models, let us look at some fintech verticals that are showing a promising sign.

Table of contents

The most investors-friendly segments of fintech industry

The fintech market is known to be the one with maximum innovation-friendliness. With the strategic implementation of new-gen technologies like AI, Blockchain, automation, IoT, etc., the domain operates in a mode of constant newness.

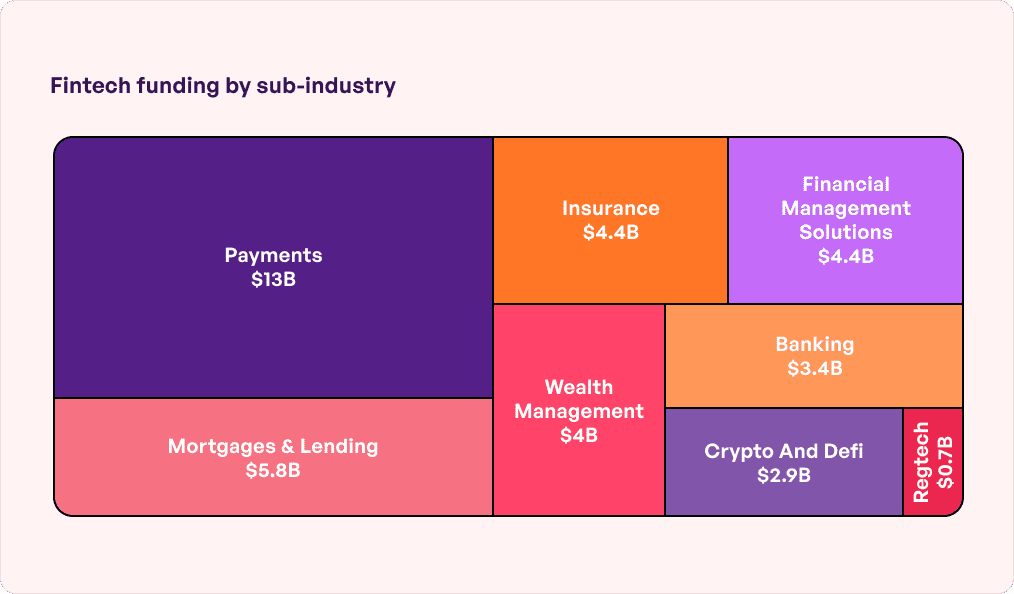

Out of the many verticals that have gained prominence in the fintech space, here are the ones that got the major chunk of funding in 2023, along with the amount.

Between these and some sub-sectors that continue to get investors’ attention, we have made a list of some hot fintech investments categories.

Wealth management

Wealth management or wealthtech as a service is a broader term for applications that deal with an individual’s wealth management across multiple facets like savings, investments, budgeting, and even automated portfolio management.

From a business perspective, some wealth management software ideas can be – financial advisory, investment management, neo-broker trading, and pension, savings applications.

Embedded finance

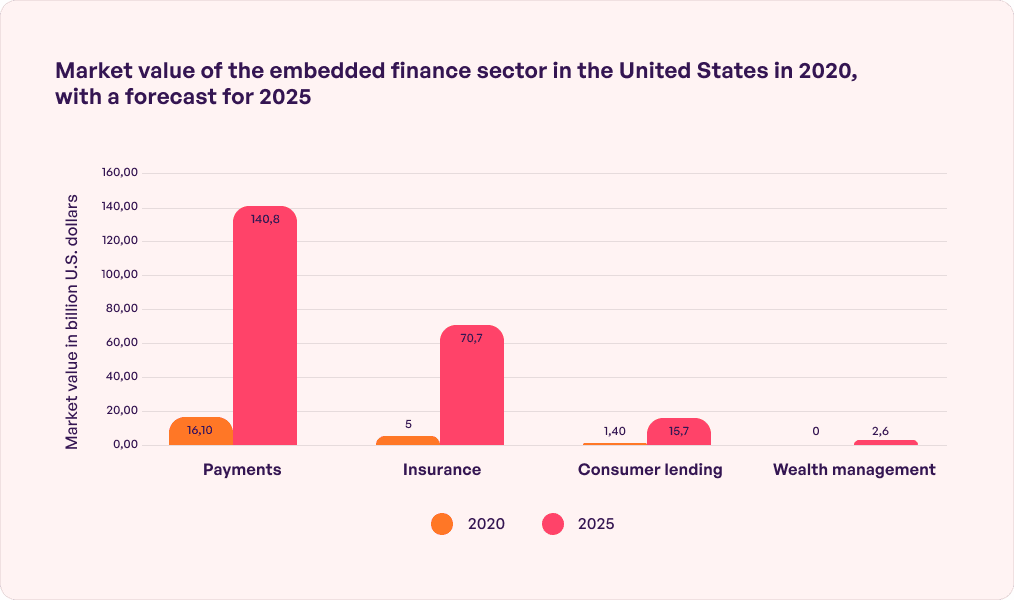

Embedded finance is when you integrate financial services in non-financial offerings. A few examples of the concept can be seen in an e-commerce merchant like Amazon providing insurance, a coffee shop app like Starbucks providing 1-click payments or a department store’s credit card.

Embedded finance is when you integrate financial services in non-financial offerings. A few examples of the concept can be seen in an e-commerce merchant like Amazon providing insurance, a coffee shop app like Starbucks providing 1-click payments or a department store’s credit card.

At the back of the convenience it offers to the users, it is estimated that embedded financial services will generate over $384.8B in revenue by 2029 – a nearly 17x increase over the $22.5B in revenue it generated in 2020.

Lending

Lending is one of those segments of fintech industry that remains at the forefront of new technology adoption and innovations. It uses financial technologies like APIs, to enable lenders with faster, more informed lending decisions. The same technology comes in handy when using alternative sources of data to measure the lending risk and linking digital platforms for improved data sharing speed.

One of the popular fintech subsectors, it empowers traditionally underserved P2P and business borrowers by providing an alternative source of funding and helping better their financial health and freedom.

Decentralized finance

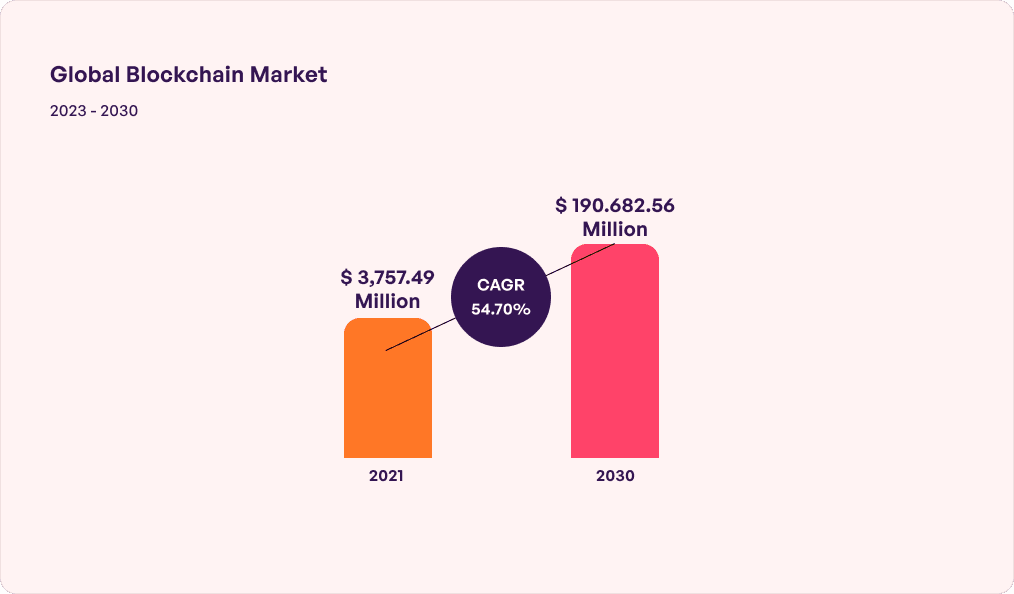

2024 is shaping up to be a potentially critical year for the crypto industry, especially for institutional investors.

With multiple factors coming together, including an implementation of the Markets in Crypto-Assets (MiCA) legislation in the European Union and pending approval of Bitcoin and Ethereum Exchange-Traded Funds (ETFs) in the United States, the platform is being set for an impactful shift in crypto assets adoption and its mainstream acceptance.

Another event that could power the rise of the crypto market is the April 2024 scheduled Bitcoin halving. If history repeats itself, 2024 halving can ignite another explosive bull run, which would attract institutional investors looking to capitalize on the potential gains.

In addition to crypto-centric projects, the domain is also witnessing a rise in questions about how to create a DAO, backed by the intent to increase the number of projects in the domain.

Banking software

Banking apps or banking as a service software has been receiving constant attention from investors, especially since traditional banks have entered the crucial phase of their journey: digitalization. On the business model end, software companies are finding them getting more inclined toward open banking and B2B SaaS products for banks, while on the banks’ end, the focus can be seen on establishing partnerships between them and tech-first companies to either sell banking services on their platform or using their technology like blockchain or AI to advance banking solutions.

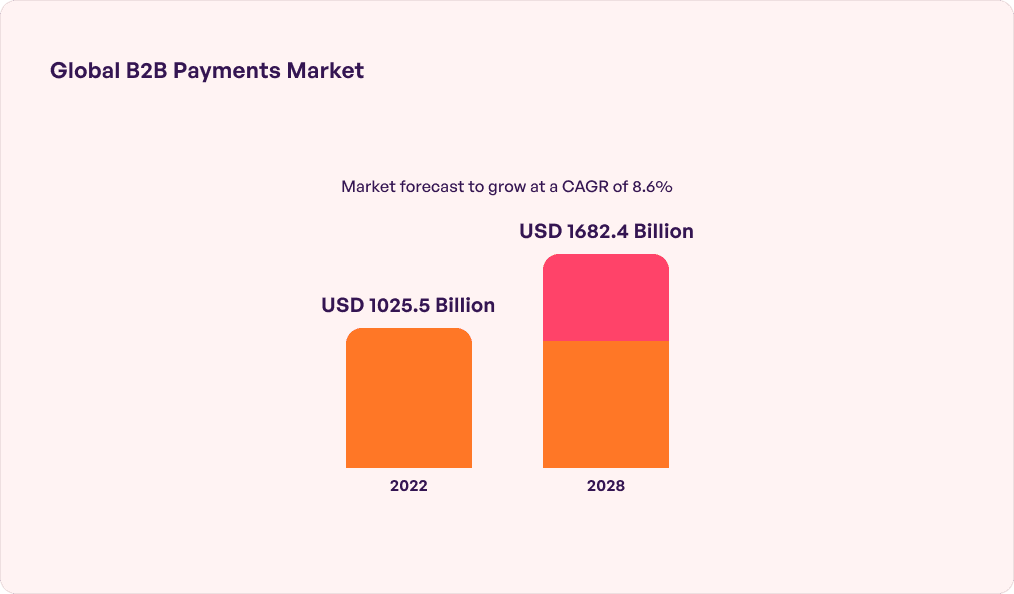

B2B payments

B2B payments as a service platform aims to solve the pestering issues of the company to vendors’ payments domain. According to pymnts.com, 63% of invoices need two to five signoffs, it takes at least 14 days to process an invoice, and 80% of all the b2b payments are made via check. This complex set of approaches has been holding the domain back while the overall payment space is becoming innovation-first.

This is where B2B payment software comes into play with their digital-first offerings.

Here were the top fintech verticals that are expected to witness massive investor interest. Now that we have looked into the fintech investments landscape, here is what you – an entrepreneur interested in entering the space with the end goal of getting funded should do.

What do investors expect from a fintech product?

After getting a high-level idea of the fintech product you would be building, it is equally critical to have some pointers to get you a seat in front of investors.

Strong business model

The number one expectation that funding agencies have when making investment in fintech is of a strong business model. Your product idea should solve mass-level issues with a creative approach, moreover, it should be unique in terms of your competitors’ offerings and revenue model.

Skilled team

Next to the business model, fintech market investments are majorly seen in companies that have a strong core team. So we recommend having industry veterans on your board along with people who have established their brand as being subject matter experts.

Market acceptance

Gather data on how well the market is accepting your product by surveying real users. One way to approach this would be to create an MVP of your fintech application and then send it to real users in return for motivators like free premium versions, cashback, or coupons.

What if we told you that there is a way you can manage financial application development and spend time charting through the complexities of fintech investments? The way to make this possible lies in partnering with a fintech app development company like us. We have a team of subject matter experts who specialize in the design, development, and deployment of multiple use cases of the finance domain.

At Simublade, we have an extensive finance app development services portfolio of products ranging from crypto payments to banking-as-a-service platforms, and even budgeting applications. Explore how we can translate our expertise into your business’s growth.